Staying Nimble: Corporate Controller Q&A

Experienced controllers on how finance can help organizations emerge from the downturn stronger than ever, and how they leverage technology to stay nimble.

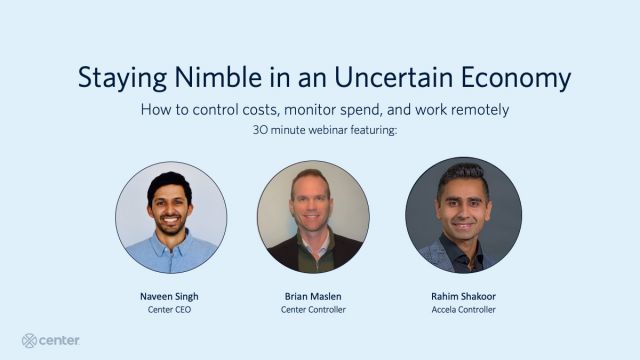

We recently sat down with two seasoned corporate controllers with decades of experience leading F&A teams at companies ranging from startups to large public companies. Brian Maslen, Center’s Corporate Controller for the past five years, previously spent more than a decade in Finance at Blackberry and Owens Corning. And Rahim Shakoor, currently Corporate Controller at Accela, has held a number of leadership roles at Docker, PwC, and the University of California, San Francisco.

Watch the entire Staying Nimble webinar here.

Here’s what they had to say about staying nimble and acting strategically during this challenging time of economic certainty, and leveraging tools and technology to come out stronger.

Q: How do you think about cost containment? What principles do you use to guide your decisions, and what are some of the challenges in making sure each dollar is productive?

BRIAN: Because we are headquartered in Washington State, we were among the first areas to feel the impact of this pandemic. We started fairly early going line by line through our financial plan to see where we should focus investment and where we might have to pull back—looking for any discretionary or redundant spend like extra software subscriptions, office space build-outs, that kind of thing.

Overall, I find it helpful to think about costs as investments rather than burdens. I look at every dollar spent (from a salesperson’s plane ticket to new production equipment) as an investment that should result in some kind of return for the company. So cost containment in my mind is really about investment decisions. The challenge is to make each dollar count and maximize its productivity. Sometimes the link between spend and return is not clear-cut, but that’s what I think about when we’re trying to contain costs. It’s really about choices.

“I look at every dollar spent as an investment that should result in some kind of return for the company. So cost containment in my mind is really about investment decisions.” Brian Maslen, Corporate Controller, Center

RAHIM: It is about making choices, but it’s hard to make good choices if you don’t have accurate, high-quality data. Today’s AP processes are heavily focused on month-end batch processing, which causes delays because of how the systems are architected. We’re constantly ticking and tying to make sure our data is accurate enough to make those decisions, which can take a number of days.

“It’s hard to make good choices if you don’t have accurate, high-quality data. Today’s AP processes are heavily focused on month-end batch processing, which causes delays.” Rahim Shakoor, Corporate Controller, Accela

Q: What are your thoughts on spending freezes or across-the-board cuts? What would you recommend to CFOs and CEOs responding to a sudden economic event like the one we’ve been going through?

BRIAN: In a sharp downturn like this, there is an instinct to act very quickly—and that is a good instinct; you do need to act quickly! But you need to act carefully as well so that you don’t sacrifice the business’s future for the sake of speed. If you have the right systems in place, you can actually do both—you can quickly make changes, but in a way that protects your business for the long term.

Across-the-board cuts are common because they are quick to implement, but they don’t consider the real needs of the business. A business is a complicated network of people, assets, and processes—so you need to carefully identify those areas that can be cut, and others that should be left alone, or even invested in further.

“Across-the-board cuts are common because they are quick to implement, but they don’t consider the real needs of the business.” Brian

RAHIM: We’re going through our budget and forecast, line by line, more often than we ever have, even on a weekly basis. It’s giving us an opportunity to ask questions. Have our core assumptions changed?

In a downturn like this, the company turns to finance to ask if we’re going to be OK. It’s important to have trust and confidence in our underlying reporting and data. We are going to be seen as leaders in this process, and we have to communicate with confidence. That all starts from getting the right data, asking the right questions, making the right decisions to project out to the business.

“In a downturn like this, the company turns to finance to ask if we’re going to be OK. It’s important to have trust and confidence in our underlying reporting and data.” Rahim

Q: You’ve mentioned the concept of “spend inertia.” What is spend inertia, and how do you avoid it?

BRIAN: I think over time, businesses tend to develop spending patterns that continue even though the return on that investment is no longer there—the spend just keeps happening because that’s what’s been done in the past. Examples we’ve run into include software licenses with too many seats assigned, and an outsourced consulting contract that had outlived its usefulness. Really it could be any cost that just needs a fresh look.

“Businesses tend to develop spending patterns that continue even though the return on that investment is no longer there—the spend just keeps happening because that’s what’s been done in the past.” Brian

But overall this inertia is really dangerous, because these costs can drain your profitability in a very subtle, almost invisible, way. This idea is related to fixed versus variable costs. It’s impossible to remain nimble when your cost base is fixed. Without some flexibility, you just have nowhere to go.

RAHIM: When I was at Docker, we had subscriptions that we didn’t really know we had, or where we were over-subscribed to the tune of almost $10,000 in a year. It’s really valuable to identify excess costs that we don’t really need.

“We had subscriptions that we didn’t really know we had, or where we were over-subscribed to the tune of almost $10,000 in a year.” Rahim

Q: One easy area to cut back on right now is travel spend. Have you reallocated that spend elsewhere? How are you thinking about travel spend for the rest of 2020?

BRIAN: Things have definitely changed. I think it’s likely that travel spend remains low for most of 2020. Even if the economy does begin to open up, it will be some time before we go back to historical travel levels.

At Center, most of our travel investment is used to generate stronger customer relationships, and of course we still need to do that, so we are making investments to connect with our customers in other ways. Face-to-face is preferred, but in the meantime we are getting creative. And a lot of that relates to how our sales and marketing teams use technology to interface with our customers. We diverted a significant amount of spend towards remote conferencing and digital marketing and other related efforts.

“Most of our travel investment is used to generate stronger customer relationships, and of course we still need to do that, so we are making investments to connect with our customers in other ways.” Brian

Q: Beyond travel, where are your go-to budget line items for quick wins? How do you think about being strategic in where you cut?

BRIAN: Where you look depends heavily on the industry and cost structure, but I approach it from two perspectives. First, there are the costs that you have complete control over, such as staffing levels, outsourcing, and consulting. You can dial back how much of these resources you use—I see this as a fairly incremental approach. Second, there are the costs (likely large costs) that you do not have full control over, such as rent and raw material prices, and you may need to reach out to your business partners: Can you get relief from your landlord? Can you renegotiate pricing with your suppliers, or your bank?

But overall, the better handle you have on your finances before a downturn, the faster you can react. You will already understand what levers can be pulled, and you can be ready to act when it happens. Part of that preparation is establishing a strong methodology and culture for budgeting, controls, and reporting at all levels of the business.

“The better handle you have on your finances before a downturn, the faster you can react. You will already understand what levers can be pulled, and you can be ready to act when it happens.” Brian

Q: What are ways you’ve invested during times like these to do more with less?

RAHIM: I think about procurement spend and software subscriptions more strategically and ask what tools are out there that can make us more efficient. Can we invest deliberately in things that are going to save time and money in the future? Tools like Center as well as Clari, which helps us forecast our business in a more timely and accurate way, and our sales tax software, which helps us avoid penalties and reduces the time it takes to do things manually.

“Can we invest deliberately in things that are going to save time and money in the future?” Rahim

Q: How do you get the rest of the company to commit to and follow through with decisions to cut spending?

BRIAN: Employee commitment is key. Employees want to be part of a successful company, and they are looking to leadership to guide them through difficult times. If leadership clearly communicates WHY changes are needed and provides a vision for the future that employees can trust, there is a strong chance that employees will embrace it. And you really need them to in order to execute on the plan and find a different way of working.

“If leadership clearly communicates WHY changes are needed and provides a vision for the future that employees can trust, there is a strong chance that employees will embrace it.” Brian

Q: What lessons did you learn from the 2008 recession or other times of business stress?

BRIAN: Part of what we learned from 2008 is that success during stable periods can mask a lot of underlying issues that are only brought to light when you go through these periods of struggle. So you need to aggressively identify and solve those issues when they arise. It’s not always easy, but if you do that, your business will be much better prepared for any future downturns.

“Success can mask a lot of underlying issues that are only brought to light when you go through these periods of struggle. So you need to aggressively identify and solve those issues when they arise. Your business will be so much better prepared for any future downturns.” Brian

As we know, forecasting is never perfect, but one thing we know for sure is that all businesses will face challenges at one time or another. So I think a little paranoia is healthy, and a lot of preparation is warranted.

Q: How do you manage the month-end close with distributed teams? How are you thinking about tools and systems?

BRIAN: A lot is being asked of finance teams right now, and compounding that pressure is the fact that teams are doing it all remotely—and maybe for the first time. It’s a real test of leadership, teamwork, and systems. Any weak links quickly become obvious: any inefficiencies in your month-end processes, manual workarounds, extra steps, and so on are now really magnified.

“Any weak links quickly become obvious: any inefficiencies in your month-end processes, manual workarounds, extra steps, and so on are now really magnified.” Brian

RAHIM: We’re in a unique environment. Some teams are closing the books for the first time remotely, and many of us have other family obligations to take care of. So schedules are a little bit different, and understanding that is the first step.

We need to focus on the systems that port data over, that plug into our GL, that reconcile data, and think about how we can meet the same deadline with a distributed team or even get it done earlier, because our investors or other stakeholders might want it more in real time. Now more than ever, it’s really important for us to provide accurate and timely data to the business. It’s critical that we avoid delays.

“Now more than ever, it’s really important for us to provide accurate and timely data to the business. It’s critical that we avoid delays.” Rahim

Q: What should finance teams be doing now to get ready for our eventual return to normal?

BRIAN: Hindsight is always 20/20, but finance teams need to be continually looking for ways to improve and eliminate waste through better technology. A lean, efficient finance organization can quickly complete those routine and mandated tasks (things like financial reporting, tax filings, and internal audit reports) so they have more time for the activities that actually drive the business forward and truly add value, like providing insights and analysis.

“Finance teams need to be continually looking for ways to improve and eliminate waste through better technology.” Brian

Moving toward integrated, cloud-based systems is really important—and that means migrating away from manual calculations, spreadsheets, and other time-consuming and error-prone activities. It’s worth stressing that integration part because most teams are using a variety of tools to get the job done—the more they talk to each other, the better.

Top Takeaways

Here are steps you can take today to stay nimble and help your business come out of this downturn even stronger.

- Look for quick wins: Review your budget line by line to look for opportunities to cut costs, eliminate spend inertia, and continue or even increase investment.

- Invest in real-time tools and technology to do more with less: Review your tools and processes to see where you can work more efficiently and adapt to changing conditions more quickly. Real-time data is more important than ever, today and in the future.

- Lead for the long-term: Bring ideas for cost containment and process improvements to your executive teams so your business can come out of the current downturn stronger.

How Center Can Help

Center was founded and built by a team of ex-Concur employees to reinvent the expense management process. We serve businesses of all sizes, from growing 50-person tech startups and nonprofits to 1,000+ employee public companies.

Center’s integrated corporate card and expense software eliminates expense reports, allows you to see spend in real time, and automatically audits 100% of expenses. Policies can be adjusted to match changing business needs—monthly, or even weekly—and everything flows right through the system. Center’s Insights dashboard displays current spend across the company for full visibility into where you stand now, not last month. Schedule a demo today to see how Center can impact your bottom line right away.