Building a Travel & Expense Policy

An organization’s foundation to controlling employee spend

Top reasons your organization needs a travel & expense (T&E) policy

It’s essential to set expectations and get everyone on the same page. A T&E policy will:

- Establish a source of truth:

Your policy serves as the go-to reference for your employees to answer questions before they even have to ask. - Create consistency to make enforcement easier:

Everyone should follow the same rules and process for submitting expenses. - Increase productivity by reducing back and forth:

A policy helps approvers, admins, and employees quickly identify what is within policy and what actions to take next.

Employee-Friendly T&E Policy Encourages Wider Adoption

Employees are busy. The more straightforward your T&E policy, the easier it is to follow—so don’t make

things overly complicated. Use these tips to get started:

- Consult multiple levels of employees for feedback to ensure the clarity of your policy

- Policies are meant to be dynamic, not one-and-done. Plan to iterate based on feedback, data insights, and any relevant changes to your business.

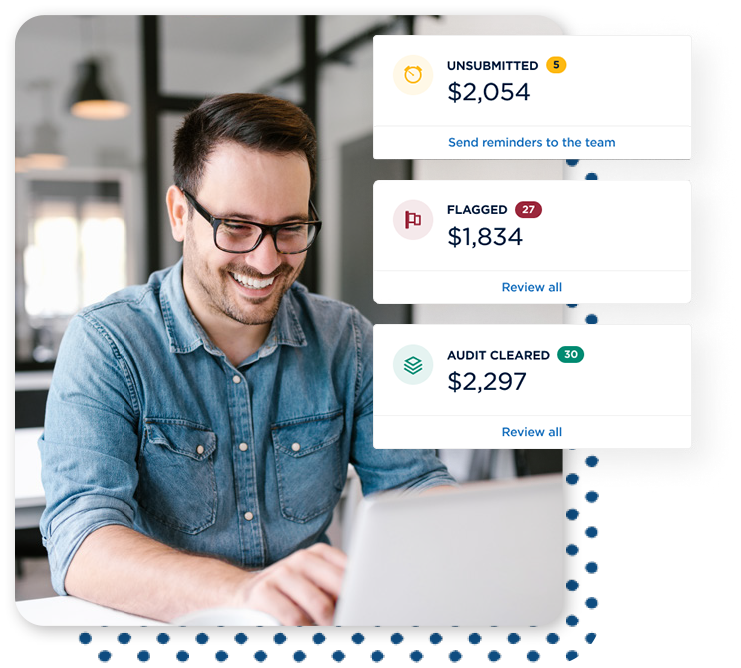

- Consider how you will manage your policy and set controls. A corporate card with integrated expense software may help you reach your policy goals more effectively

Essential T&E policy areas to address

There are key policy areas that include difficult-to-control and high-cost line items, so you’ll want to strategize, document, and have a solid approach to managing.

Only 39% of companies report having a written, up-to-date travel and expense policy.

Travel

Business travel is on the rise. Having a plan in place now will help your organization better manage current expenses and future trip spend. Best practices include:

- Starting adoption early. Set reasonable guidelines and consult a few travelers of various employee levels and departments for feedback.

- Helping employees to travel smarter and with purpose. Ensure they have support (and know how to access it) while traveling.

- Simplifying booking and expensing for employees with an all-in-one travel, corporate card, and expense solution that features rich travel inventory, self-service itinerary changes, and expert customer service.

Meals and entertainment

These expense types tend to apply to all, not just travelers, and can include multiple people across departments/clients. To help maintain control, consider:

- Requiring attendees to be listed and determining the best person or department to assume these expenses ahead of time

- How you require classification of these for any tax deduction purposes

- Using an integrated corporate card and expense software to enable visibility

Mileage

As the hardest to review and easiest to shortcut, mileage is one of the biggest culprits of unnecessary spend. Our recommendations to course correct include:

- Use IRS rate

- Educate approvers to look for ‘double dipping’ of gas + miles or other car-related expenses (assuming not fleet cars) and review insights frequently

- Requiring use of a map feature to accurately track routes taken

Miscellaneous expenses

Though helpful when you start, unclassified spend contributes to wasted time and leakage and should be used in limited capacities or removed once categories are established.

Focusing on these key categories by setting stricter parameters can help reign in unnecessary spend and reduce potential iterations to your policy.