Connected

Card Program

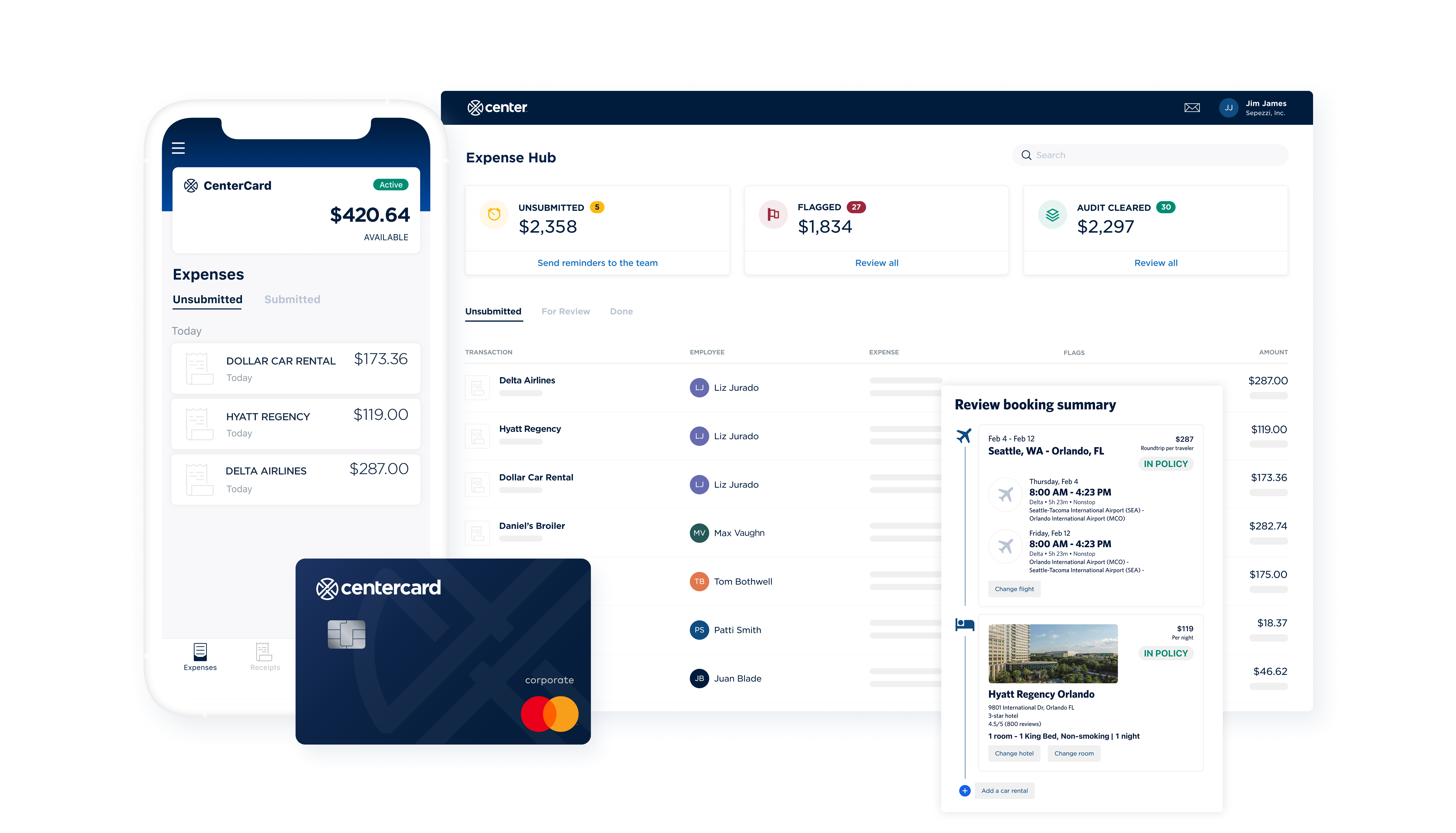

CenterCard + integrated expense and travel management software

We’ve integrated corporate cards with software and a mobile app to make managing company spend simple

A Corporate Card Everyone Will Love—

Even Your CFO

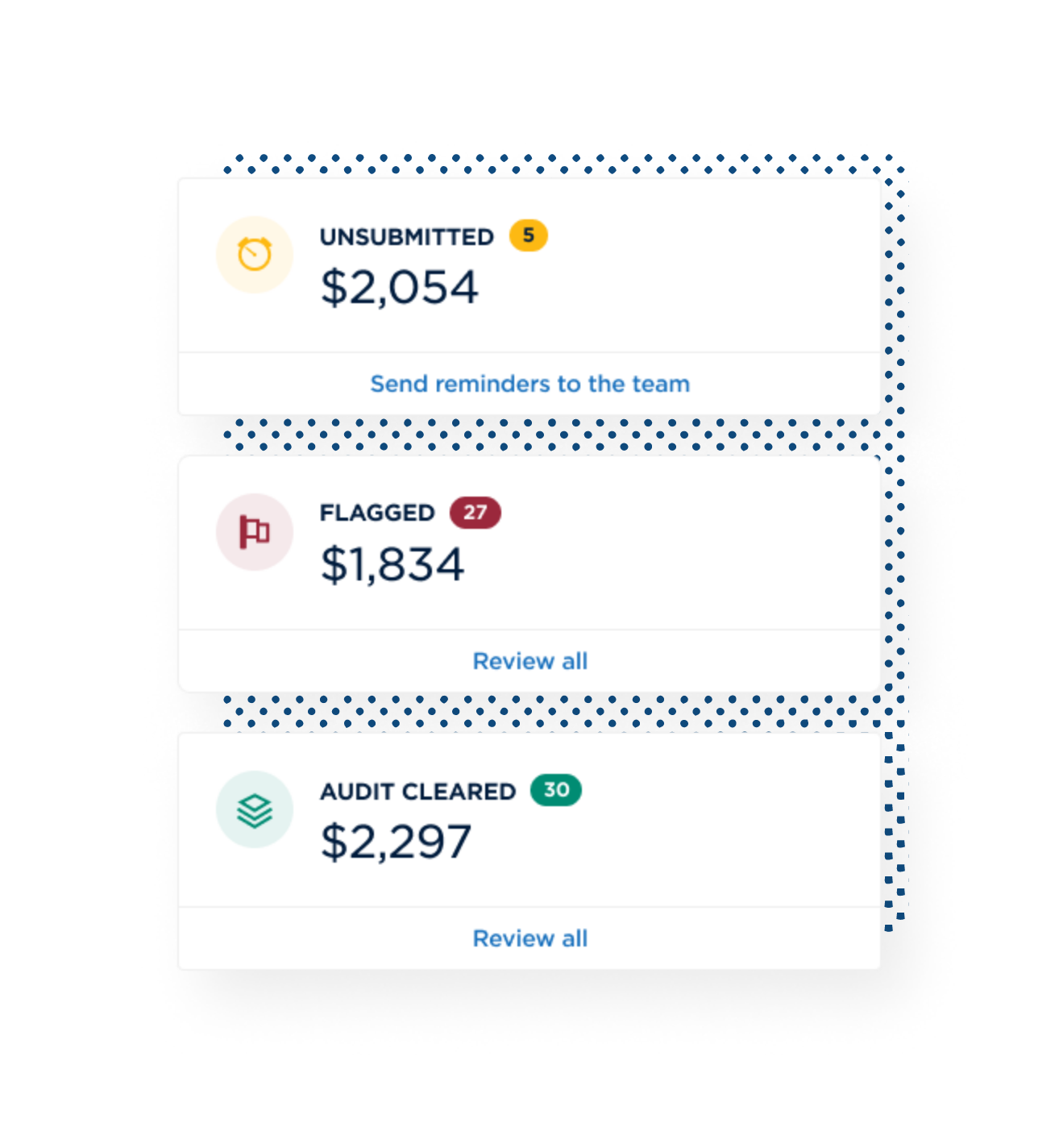

Finance & Accounting

See all company spend as it happens, including unsubmitted expenses. Automate card reconciliation, improve billable accounting, and monitor tough-to-track expenses.

Employees

Use CenterCard for company purchases—no need to use personal cards or wait for reimbursement.

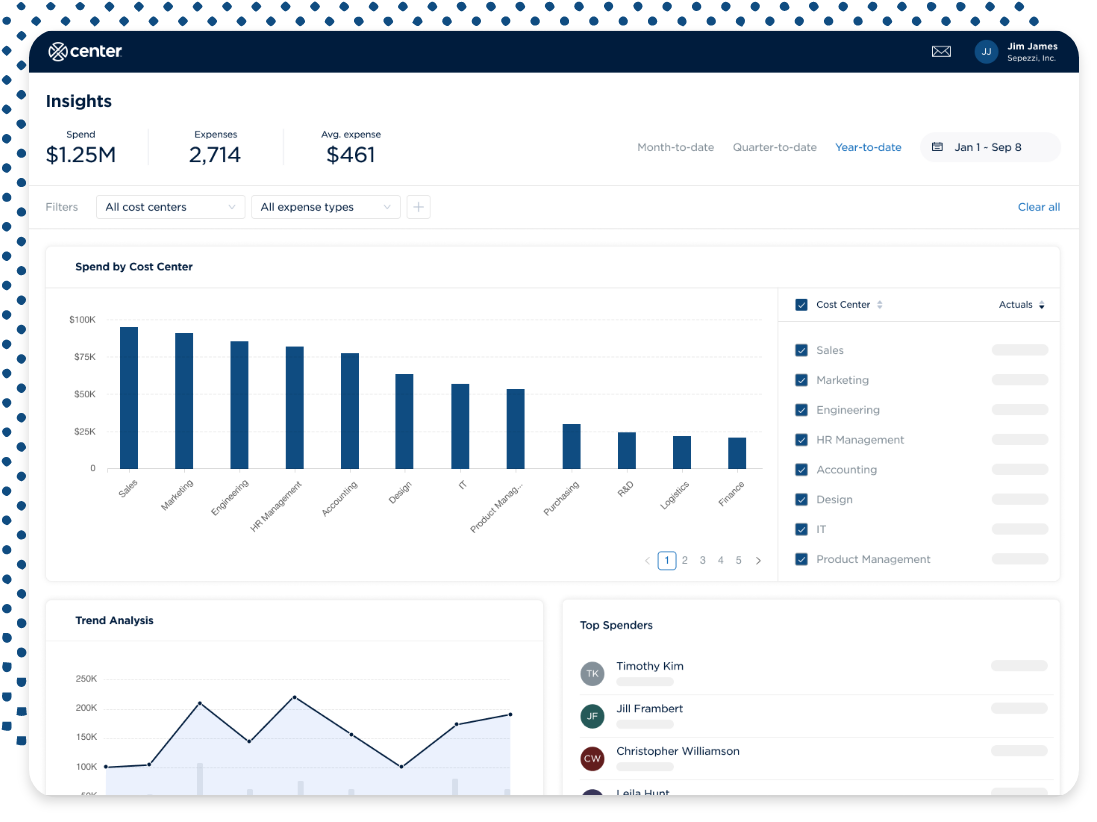

C-Suite

Build a strong fiscal culture that empowers your team to stay on track with flexible controls and adjustable policy flags. Use live analytics to view and analyze spend across the company.

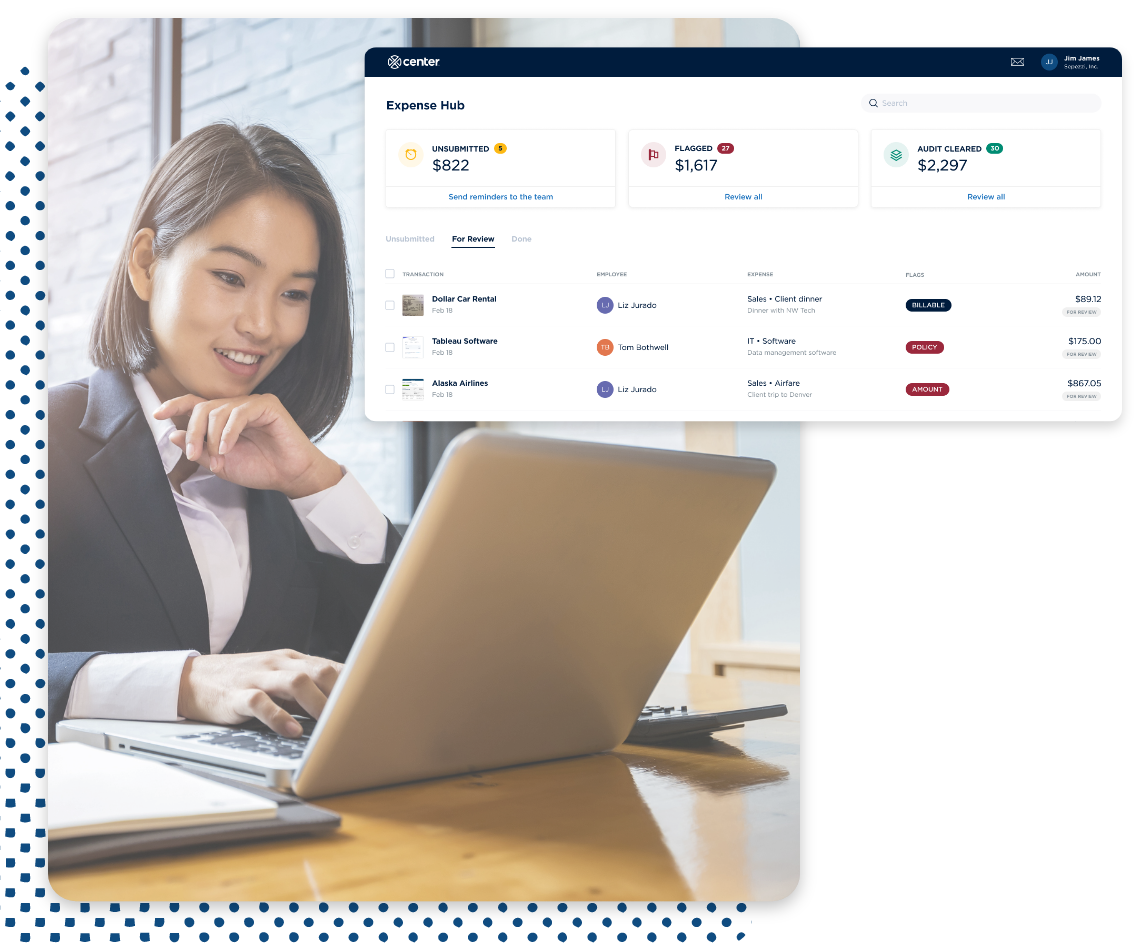

Powerful Software Puts Expenses in their Place

Expense management is essential but shouldn’t be burdensome. Center eliminates tedious tasks like receipt wrangling, manual audits, and procurement card reconciliation, freeing your team to focus on more strategic work.

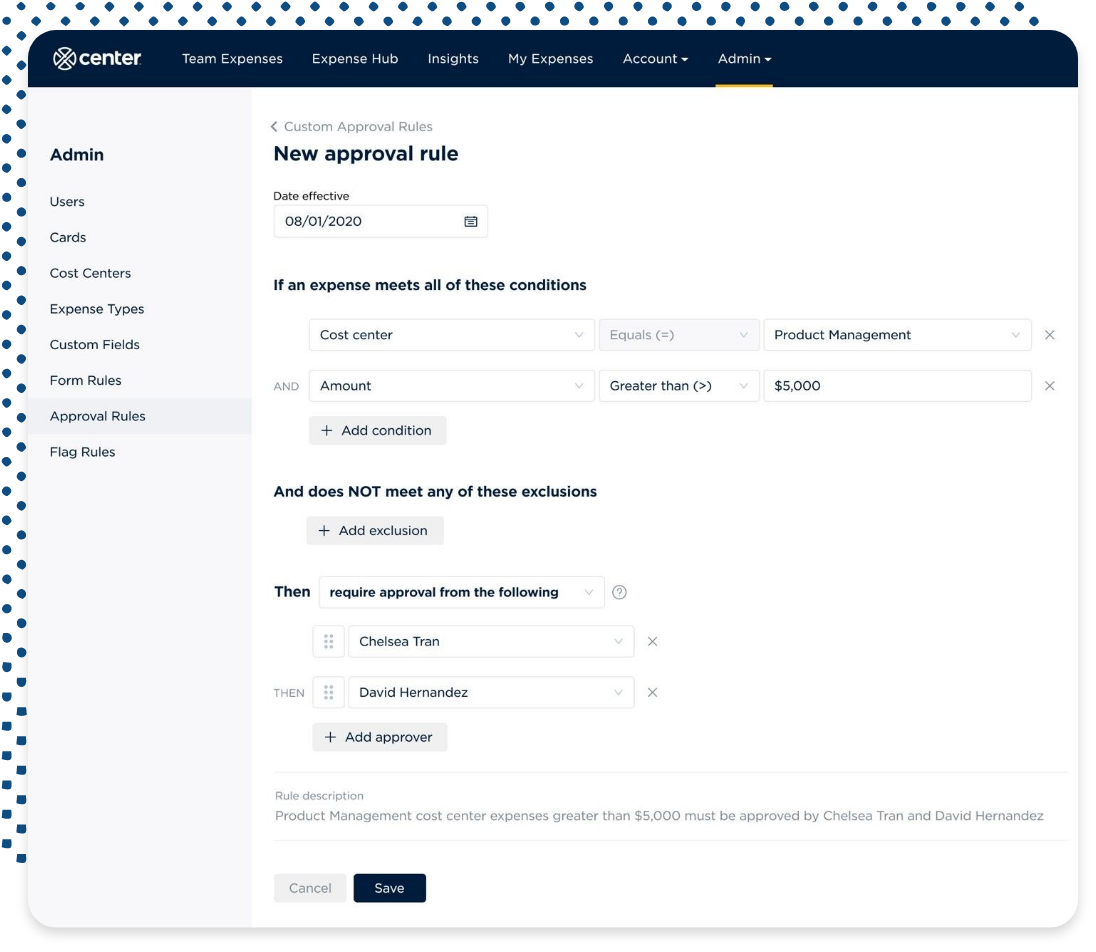

Approvals

Dynamic, streamlined workflows speed expenses through review to GL.

Audits

AI-powered auditing flags only the expenses that require attention.

Analysis

With full visibility, your team can use real-time actuals to focus on the big picture.

Achieve More with Center

One Complete Program

With the card at the center, our full-featured expense solution allows you to see in real-time, control, and manage all employee spend in one place.

Employee Purchasing Cards

Empower employees and teams with individual and department cards. CenterCard is accepted everywhere Mastercard is accepted.

Flexible Card Controls

Set adjustable limits for each card and securely lock what’s not in regular use.

User-Friendly Admin Tools

Everything you need to easily and flexibly manage corporate cards.

Service and Support Included

Every Center customer receives a dedicated deployment manager to get up and running smoothly. CenterCard includes fraud coverage, travel insurance, and 24/7 support.

No Upfront Fees

Center’s revenue model is based on interchange fees; every time you use CenterCard the merchant pays a small fee to Mastercard, which is shared with Center.