Center Introduces Credit, QuickBooks Integration

Center improves accounting speed and accuracy with the launch of its new corporate credit card program and QuickBooks Online integration.

Center Improves Accounting Speed and Accuracy with Launch of New Credit Card Program and QuickBooks Integration

Center extends expense management solution as economic downturn highlights urgency for better systems to control costs and monitor spend

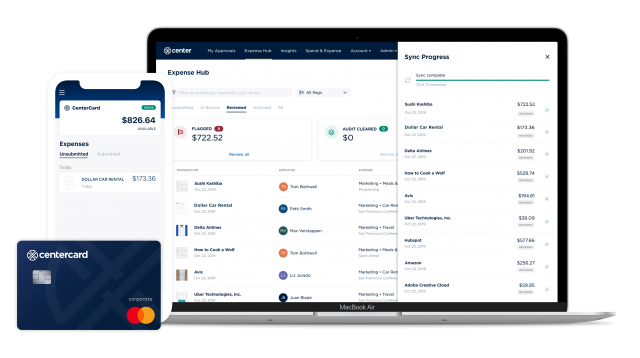

Bellevue, Wash. – July 30, 2020 – Center, a technology company helping businesses manage and optimize spend, today unveiled two new product offerings: the Center® Corporate Credit Card powered by Mastercard® and the QuickBooks Online Connector. CenterCard is issued by Comdata, Inc., pursuant to a license from Mastercard. As part of Center’s complete real-time expense management solution, these new features enable finance teams to access working capital, speed up expense deployments, and improve accounting accuracy.

“In the current economic downturn, it’s become more critical than ever for organizations to have accurate, real-time financial data,” said Naveen Singh, Center co-founder and CEO. “The new features we are announcing today, CenterCard Credit and the QuickBooks Online Connector, in combination with Center Expense software, help organizations gain immediate visibility into business expenses to effectively manage cash flow, control costs, and invest in resources.”

Center® Corporate Credit Card Powered by Mastercard®

The Center® Corporate Credit Card program, issued by Comdata, Inc., comes bundled with the powerful Center Expense software, which helps businesses manage and track spend from the point of purchase through review, approval, and reporting. It includes simple but flexible card administration to set spend limits and expense policies. Organizations using CenterCard and Center Expense reduce time spent tracking receipts, manually auditing expenses, reconciling card statements, processing accruals, and updating the general ledger by 70 percent or more.

Benefits include:

- Flexible and interest-free payment options.

- Direct integration with Center Expense software for seamless reconciliation of card expenses to save accounting time and improve accuracy.

- Easy, self-service administration tools to issue cards, set and change limits, and lock cards, as well as automate deposits and transfers.

- Intelligent fraud monitoring, including mobile alerts when an issue arises.

- Acceptance worldwide at all 35.9 million locations where Mastercard® is accepted.

“Comdata, Inc. is pleased to partner with Center and grow its overall footprint in the commercial card market,” said Chris Shanahan, SVP of Comdata’s Strategic Partners Group.

“Using CenterCard has greatly improved the accuracy and efficiency of our month-end closing,” said David Cohn, CFO of Ducky Recovery, a Center customer. “As a construction company, it’s critical that all expenditures get assigned to jobs with proper documentation. Our Field Project Managers use the CenterCard mobile app to document their credit card purchases instantly. We then import all expense information directly into our accounting system, saving time during our month-end close.”

QuickBooks Online Connector

Center now offers direct integration with QuickBooks® Online, the leading accounting software for small and mid-size businesses. Center customers use the new QuickBooks Connector to set up their expense software in minutes and automatically sync expense data to QuickBooks, eliminating the manual data entry and accounting errors that occur even with traditional expense management software. The QuickBooks Online Connector, which enables increased visibility and controls over employee expenses, is available to all Center customers at no additional charge.

Benefits include:

- Faster set up of Center Expense with custom QuickBooks configuration, including accounts, classes, and custom fields.

- A faster month-end close with automatic exporting of expense data directly to QuickBooks Online.

- Real-time reporting of all expenses, including unsubmitted, to help finance teams and business leaders make informed decisions.

For more information on the new credit offering, QuickBooks Online integration or to request a demo, visit getcenter.com.

About Center

Center ID Corp., doing business as Center, helps organizations thrive by getting the most of every dollar–and hour–spent. With its integrated corporate card and expense software, Center uses real-time data to track spend as it happens for better visibility, live analytics, and cost savings. Center was founded in 2014 and is based in Bellevue, Washington. For more information on Center, please visit getcenter.com.

About Comdata

Comdata is a leading provider of innovative B2B payment and financial technology. By combining its strong capabilities in technology development, credit card issuing, transaction processing and network ownership, the company helps clients build electronic payment programs that can positively impact the clients’ bottom line and operate their businesses more efficiently. Comdata is one of the largest commercial issuers of Mastercard, and the largest fuel card issuer, in North America. For more information, visit www.comdata.com.

TAKE THE NEXT STEP:

Ready to explore adopting a new corporate card program or look into making a move? Center’s integrated corporate card program and AI-powered expense software was created to deliver on driving operational efficiency, help you optimize your spend, and enhance visibility within organizations of every shape and size. Want to learn more? See Center in action.