The Problem With the Expense Management Status Quo

Auditing is a manual, time-consuming process made more difficult by the typical batched expense report. The right tools can ensure all spend is within policy.

AUDIT APPROACHES VARY BY ROLE AND COMPANY SIZE

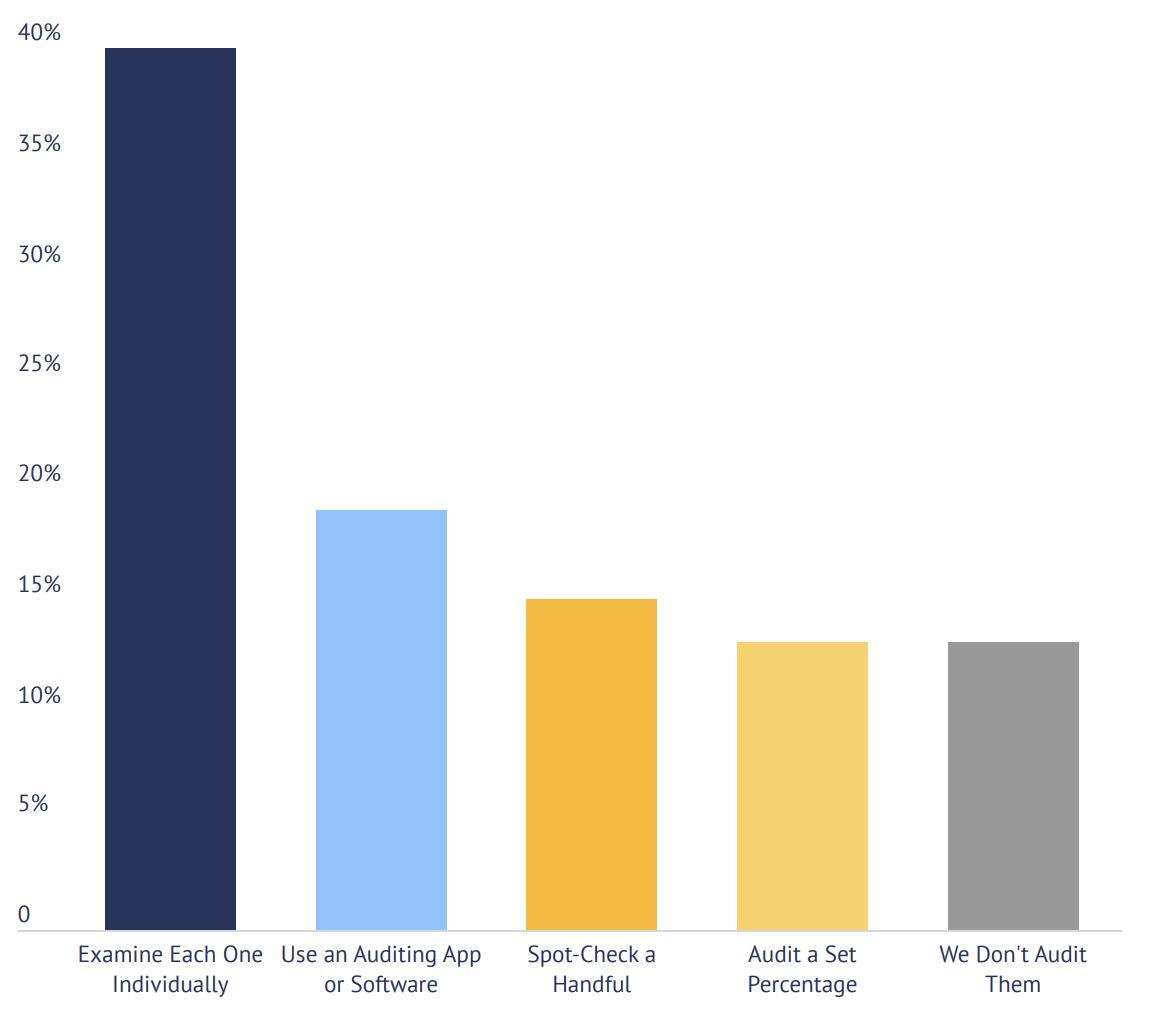

In our 2019 Expense Management Report, Under Pressure: Operational Challenges for Finance Teams, we asked finance professionals how they approach the audit process. From not auditing at all to reviewing everything by hand, we found some similarities—and some big differences—in how companies manage expense audits.

Most finance teams say they audit some or all expense reports (87%). The specific approach depends largely on company size and role.

The most common, according to 40% of respondents, is to examine each report individually. The next most common method, cited by 20%, is to use auditing software.

Out of all job titles, CFOs were far and away most likely to say that their teams examine each report individually (70%).

Controllers, accountants, and procurement managers were also likely to say they examine each report individually. This makes sense given that these roles are on the front lines of the spend management process.

This same approach is also the most common (51%) for small companies under 100 employees, which is feasible given the scale of reports to review. Surprisingly, “examine each individually” is also most common for large companies over 1000, although at a lower percentage (37%).

Of all respondents, mid-size companies are most likely to use auditing software compared to their smaller or larger counterparts.

Which Best Describes Your Approach to Auditing Expense Reports?

TO THE POINT:

Auditing expense reports is a critical part of the expense process for the majority of finance teams, although the responses may show a difference between the ideal and the practical. Auditing is a manual, time-consuming process made more difficult by the traditional batch-based expense report. Auditing software tools can make a huge difference by eliminating the need for manual review and ensuring that all spend is compliant and within policy.

ACCEPTING THE STATUS QUO

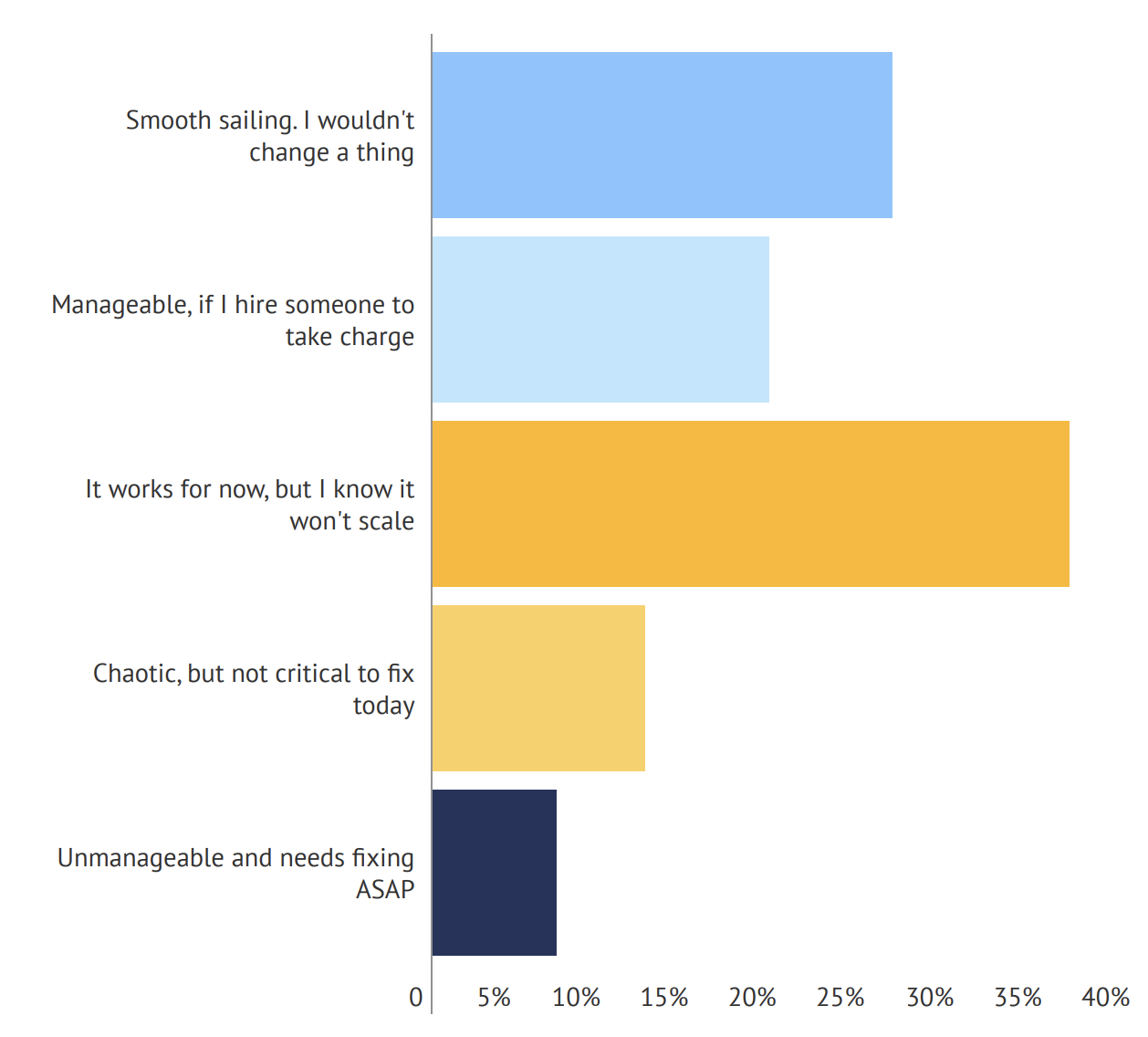

Just a quarter (26%) of respondents are happy with their current expense management process, selecting “Smooth sailing. I wouldn’t change a thing.”

However, only 7% of respondents say the process is so bad that it needs fixing ASAP. The rest (67%) say it’s manageable for now.

Which Best Describes Your Current Process for Managing Employee Spending?

Interestingly, CFOs and procurement managers were most likely to choose “Smooth sailing” as responses (41% and 50%). All other roles, but especially those on the front line such as controllers, auditors, accounting, and FP&A, said the process works for now but won’t scale.

Responses varied by company size. Those in large organizations were more likely to say “Smooth sailing” (38%).

Mid-size companies were least likely to agree (13%). They were more likely to select “Works for now but won’t scale” (45%) or “Manageable, if I hire someone” (20%). This last option was even more prevalent at the smaller end of mid-size companies (100 to 499 employees).

Small companies were almost evenly split between “Smooth sailing” and “Works for now but won’t scale.”

TO THE POINT:

The fact that only 26% of respondents say they wouldn’t change a thing about their process for managing employee spend but just 7% say it needs fixing ASAP points to a general complacency around expense management. Streamlining processes is important, however, especially as companies grow, so that activities like tracking and auditing expenses don’t spiral out of control.

View the full results of our 2019 Expense Management Report.